Antimony: The Defence Mineral at the Heart of Global Supply Chain Tensions

As the global scramble for critical resources heats up, an often overlooked mineral—antimony— is becoming a key player in the fight to secure national security and technological dominance. With its essential roles in defence, energy, and industrial applications, antimony is now at the forefront of a new supply chain battle that could reshape the entire market.

Why Antimony is Critical

While it’s not the kind of mineral that makes headlines often, Antimony quietly supports some of the most vital industries and sectors of the economy. It’s used in everything from defence and batteries to green technologies. It might not be glamorous, but it’s essential.

Defence Applications: Antimony plays a key role in military uses, from strengthening ammunition to producing armor-piercing bullets. It’s also essential in critical defence materials, contributing to military equipment, batteries, and flame retardants.

Industrial Uses: Antimony is vital for manufacturing lead-acid batteries and semiconductors. It supports key industries such as electronics, automotive, and energy storage, making it a cornerstone of modern industrial processes.

Supply Chain Vulnerabilities: With the majority of global antimony production concentrated in China, there’s a significant strategic risk. Western nations, including the U.S., face potential disruptions that could severely impact industries reliant on this critical mineral.

A Global Wake-Up Call

China currently produces 70-80% of the world’s antimony, and in August 2024, it announced plans to restrict exports, citing national security concerns. This move sent shockwaves through global supply chains, highlighting just how crucial antimony has become. The West's heavy dependence on Chinese production has exposed a major vulnerability, sparking an urgent effort to diversify supply sources, particularly in North America.

In the U.S., projects like the Stibnite Gold Project in Idaho (owned by Perpetua Resources) are aiming to establish domestic antimony production, though they are still years away from doing so. The U.S. government recently announced additional funding for Perpetua's Stibnite project and is fast-tracking the permitting process to expedite access to this critical mineral.

"We believe that the Stibnite Gold Project is a win-win-win," said Jon Cherry, President and CEO of Perpetua Resources. "It's a win for Idaho, it's a win for the environment, and it's a win for America's national security. Our independence from Chinese control over antimony is right here in our backyard, and Perpetua Resources is honored to provide a critical part of the solution to the United States' strategic need for antimony, while also delivering an economically robust gold mine that will create new jobs in Idaho. It's time for the Stibnite Gold Project to help secure our future."

Similarly, Canada holds potential reserves but lacks significant operational mines, creating an opportunity for new ventures to fill the gap.

Rising Global Tensions Drive Urgent Demand for Domestic Antimony Supplies

In a world growing more divided by the day, the stakes are climbing, pushing us closer to outright conflict—and making secure, domestic access to critical defence resources like antimony more urgent than ever. Political and military tensions are mounting on multiple fronts, from the ongoing hostilities between Israel and Iran to flashpoints in Eastern Europe and the South China Sea. The demand for strategic minerals is intensifying, and China's recent decision to clamp down on antimony exports shows just how serious the situation has become. For Western countries, this isn’t just an economic issue—it’s a wake-up call. Relying on foreign supply chains for something as essential as antimony, which is critical for ammunition, batteries, and military armour, leaves national security hanging by a thread.

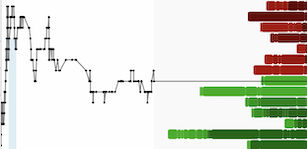

Antimony Prices Soar Amid Global Supply Disruptions and Rising Demand

Over the past year, antimony prices have surged dramatically due to tightening global supply and increased demand for its use in defence, batteries, and flame retardants. China's mid-2024 decision to cut exports, as the dominant producer, has driven prices up from around $15,000 per tonne in early 2023 to over $30,000 per tonne currently, reflecting mounting supply chain concerns and geopolitical pressures.

Military Metals Takes Action: Acquiring West Gore Antimony Project

Military Metals Corp. is making a bold move into the antimony market with its acquisition of the West Gore Antimony Project in Nova Scotia, Canada. This is no ordinary acquisition—West Gore was once the country’s largest antimony mine, with a history dating back to the late 19th century. Mining ceased during World War I when a shipment of antimony ore was torpedoed and sunk, leading to the company’s bankruptcy at the time. Today, Military Metals is determined to revive this historic project.

West Gore is a brownfield asset with a rich legacy as Canada’s most prominent antimony mine, operating from 1882 to 1939. Historical high-grade results, including 7.07 meters of 10.6 gpt gold and 3.4% antimony, demonstrate its potential as a valuable resource. During its peak, West Gore played a significant role in the global antimony supply chain.

The numbers paint a pretty enticing picture: those old waste rock dumps still hold up to 570 tonnes of antimony and 2,500 ounces of gold. With current market prices—$35,000 per tonne for antimony and $2,700 per ounce for gold—that’s over $27 million in potential value. And the kicker? They picked it up for just $85,000. Now that's what I call a bargain.

"The acquisition of the West Gore Antimony Project demonstrates our strategy of becoming a significant global antimony player to give our shareholders exposure to the attractive metal. Antimony has experienced a recent price increase primarily due to supply constraints, including China imposing export restrictions. Antimony has an import role in military munitions and equipment. Numerous countries have included antimony on their critical metals list given its strategic importance to military activity, in addition to consumption in fire retardants, solar energy and nuclear power plants," said Scott Eldridge, CEO of Military Metals.

Military Metals is moving quickly. The next steps include assessing the grade and processability of the old stockpiles and tailings, with exploration scheduled to begin in late 2024. This sets the stage for an exciting period ahead, both for the company and for investors.

Expanding Its Reach in Slovakia: Military Metals Moves East

In a bold strategic move, Military Metals has finalized an agreement to acquire three additional brownfield projects in Slovakia: the antimony-focused Trojarova and Tienesgrund properties, and a tin project, Medvedi. Trojarova, potentially one of the EU’s largest antimony deposits, has seen extensive historical exploration, with 63 drill holes and significant underground workings established in the 1980s-1990s. A historical resource estimate for Trojarova, based on a 1.0% antimony cut-off, indicates a deposit of approximately 2,461,599 tonnes with an antimony grade of 2.470%, translating to around 60,800 tonnes of antimony. With antimony prices currently at $34,000 per tonne, the in-situ value of the antimony alone is over $2 billion. This acquisition aligns with the EU’s Critical Raw Materials Act, positioning Military Metals as a pivotal player in reducing reliance on Chinese antimony supplies.

"This acquisition strategically positions Military Metals as a leading explorer and developer of antimony," said CEO Scott Eldridge. "The Trojarova and Tienesgrund projects offer significant potential for rapid advancement, particularly given Slovakia's strong mining infrastructure and history. We see this as a perfect alignment with the EU’s Critical Raw Materials Act, opening the door to potential EU funding sources as we advance these projects toward production."

CEO Eldridge emphasized, "Acquiring Trojarova marks a transformative step towards strengthening Europe's access to essential raw materials. As trade tensions and demand for strategic minerals surge, Trojarova and our Slovakian assets offer a path to reduced dependence on Chinese imports, a resilient, self-sufficient supply for critical materials."

Building the Antimony Trifecta: Military Metals Adds Strategic U.S. Asset with Last Chance Acquisition

Military Metals Corp. has added another notch to its antimony belt with the acquisition of the Last Chance Antimony-Gold project in Nye County, Nevada, further cementing its reputation as a powerhouse in the antimony space. This new U.S.-based asset joins the company's robust portfolio of critical mineral projects spanning Europe, Canada, and now the United States—a "trifecta" that strengthens Military Metals' standing as a leader in the antimony market. Located near the historic Round Mountain Gold Mine, the Last Chance project has a legacy dating back to the early 20th century, with documented antimony production from both World Wars and renewed exploration interest during the 1980s.

By expanding its asset base with this historic project, Military Metals is strategically positioning itself to become a key player in the critical mineral supply chain outside of China. The Last Chance property includes five unpatented mineral claims, with Military Metals set to commence detailed mapping, sampling, and a focused drilling program to explore the full potential of the antimony and gold mineralization. This acquisition aligns with the company's commitment to secure domestic antimony supplies, which are crucial for defense and industrial applications, and it further demonstrates Military Metals' agility in acquiring high-potential assets at a time of heightened demand. The Last Chance project not only reinforces Military Metals' strategic growth but also strengthens the West’s access to a reliable antimony supply as global supply chain vulnerabilities continue to escalate.

Securing the Future of Critical Minerals

Military Metals is stepping into the spotlight at a crucial time, as global supply chains for critical minerals are strained. By reviving the historic West Gore Antimony Project and expanding its reach into strategic European assets, the company is positioning itself as a leader in securing antimony supplies outside of China. This bold strategy could reshape the market and offer a lifeline to industries dependent on this vital mineral.

DISCLOSURE

The author is a paid advisor to Military Metals Corp and may own shares in the company. The author may choose to buy or sell shares at any time without notice. Although efforts have been made to ensure the accuracy and reliability of the information presented, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the small-cap company mentioned.